Introduction:

Based in Mumbai, Multi Commodity Exchange or MCX is an independent commodity exchange in India. With its vast reach of more than 800 cities and towns in India and about 1,30,000 trading terminals, MCX is the largest among the five officially recognized electronic multi-commodity exchanges in India. India’s No. 1 commodity exchange, MCX has a strong foothold with over 83% of the market share. It offers futures trading in over 50 commodities including bullion (Gold and Silver), ferrous and non-ferrous metals, energy, petrochemicals and numerous agricultural commodities (cash crops) including mentha oil, cardamom, potatoes, palm oil etc.

Established in the year 2003, as of 2011, MCX is ranked at the fifth place in the global commodity bourses in terms of the number of futures contracts traded. MCX COMDEX is India’s first and only composite commodity futures price index. Financial Technologies (I) Ltd., State Bank of India and associates, National Bank for Agriculture and Rural Development (NABARD), National Stock Exchange of India Ltd. (NSE), Fid Fund (Mauritius) Ltd., Corporation Bank, Union Bank of India, Canara Bank, Bank of India, Bank of Baroda, HDFC Bank, ICICI ventures, Merrill Lynch, and New York Stock Exchange are among the key stakeholders of MCX.

As the first ever Indian exchange too come out with its IPO (Initial Public Offering), MCX Ltd is entering into the capital markets with an initial public offering, IPO of 6,427,378 Equity Shares of Rs. 10 each. The price band for the issue has been fixed at Rs. 860/- at lower level and Rs. 1032/- at upper level. MCX IPO opened on February 22, 2012 for subscription and closed on February 24, 2012. And, by 23rd February, it had received a record ,46,52,896 bids for shares as against its issue size of 55,00,772 shares. MCX IPO finally oversubscribed 54.10 times on its closing day. The price for the

public issue was fixed finally by MCX at Rs. 1032/- on 27th February 2012.

The listing date is yet not confirmed. Ganesha, with the help of Vedic Astrology, attempts to determine the fate of the IPO and its effect on the stock

market.

Technical Data

Exchange wise market share of financial year 2010 : –

- MCX 82.30%

- NCDEX-11.80%

- NMCE 2.90%

- Indian Commodity Exchange Limited (ICEX) 1.80%

- ACE 0.10%

- Others 1.1

Issue Detail:

- Open: Feb 22, 2012 – Feb 24, 2012

- Type: 100% Book Built Issue IPO

- Size: 6,427,378 Equity Shares of Rs. 10

- Size: Rs. 663.31 Crores

- Face Value: Rs. 10 Per Equity Share

- Issue Price: Rs. 860 – Rs. 1032 Per Equity Share

- Market Lot: 6 Shares

- Minimum Order Quantity: 6 Shares

- Listing At: Bombay Stock Exchange

Expected Allotment Date05-Mar-2012

Expected Refund Date06-Mar-2012

Expected Listing Date 07-to-09-Mar-2012 (Expected)

Astrological Analysis:

MCX started its operations in November 2003. However, the exact incorporation date for the same is unavailable, and hence plotting a chart for the

Exchange is not feasible.

The exact date on which the issue would be listed is also not available. Hence, Ganesha looks at the horoscope of the three probable days on which the issue may be listed. These three dates are 7th March, 9th March and 12th March 2012. On 8th March, the Exchange would remain closed on occasion of Holi.

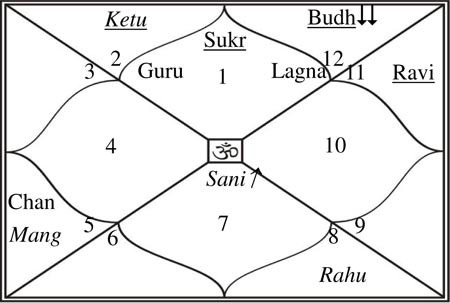

If Listing Date is 07/03/2012

On 07-03-2012, the conjunction between Moon-Mars shall occur in the speculation House. And, during this time the Lord of the speculation House shall be posited in the zodiac sign Aquarius in such a manner that it shall form an aspect with its own House.

Moon is the Lord of the 4th House, and it shall be posited in the Madhya Nakshatra. Meanwhile, Mars ascendant, the Lord of the 8th House, shall be posited in the Purvafalguni Nakshatra. Besides, Ketu Maha Dhasha shall continue till 14-12-2015, while Rahu Antar-Dhasha shall continue till 01-12-2012.

Keeping all the aforementioned planetary aspects, if the MCX IPO listing takes place on 07-03-2012, then Ganesha advises the investors to make gradual exits while making profits. The short-term view in such a case shall be barely average. Ganesha doesn’t see a lot of opportunity in such a scenario.

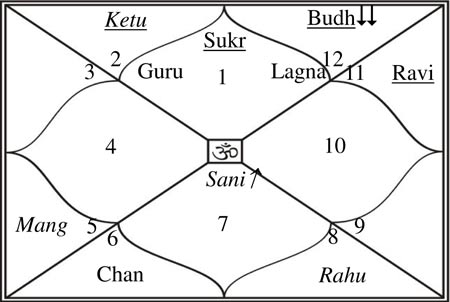

If Listing Date is 09/03/2012

Apart from the Moon moving from the 5th House to the 6th House, and in the Uttarfalguni Nakshtra (constellation), there shall not be any other major planetary shifts on 09-03-2012. However, if listing happens on this day, the scrip shall be under the influence of Sun’s Maha Dasha from this day onwards, which shall last till 21-04-2012. Also, Mercury’s Dasha is going to continue till 14-12-2012, which is why the scrip is going to be more popular with the intraday traders than it may be with the regular investors. The reason for this is that the 6th House is the signifier of the intraday jobbing at stock market. And therefore this particular listing day is likely to be very favourable for intraday jobbing, predicts Ganesha.

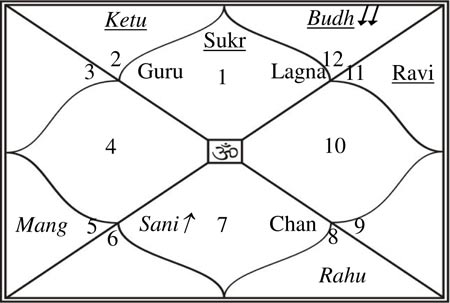

If Listing Date is 12/03/2012

On 12-03-2012, Mercury shall be in a retrograde motion in the Zodiac Sign Pisces. This is a debilitated sign for Mercury. Thus, on 12-03-2012, Mars and Mercury shall be in a debilitated sign, while Saturn shall be in the exalted sign.

On this day, Moon shall be in the Zodiac Sign Libra in the Swati Nakshatra (constellation). And, Saturn and Moon shall make a combination. From this very day onwards, Mars’ Antar-dasha in Rahu’s Maha-dasha shall begin, and this will continue till 07-09-2012.

Thus, if listing happens on this date (12th March 2012), volatility and confusing signals can be expected. This shall happen due to the planetary combinations getting formed between Mars-Rahu and Moon-Saturn, on this day. Ganesha advises His patrons to be careful of the illusions, which may get created during this time in the market. Overall, the long-term results shall be profitable. However, if you see the possibility of small gains in the short-term as well, Ganesha advises you to make profits and exit gradually.

Ganesha wishes all the traders and investors all the luck.

With Ganesha’s Grace,

Dharmeshh Joshi,

The GaneshaSpeaks Team