Money Principles to Skyrocket your Bank Account - How to Make More Money?

Money is an essential aspect of our lives, and it is necessary to have enough of it to cater to our needs and wants. However, making more money is easier said than done. You may be putting in long hours at work, but your bank account remains stagnant. The truth is, you need to have a solid financial plan in place to increase your income and grow your wealth. In this blog, we will discuss some money principles that can help you skyrocket your bank account.

Spend Less Than You Earn

One of the most basic principles of building wealth is to spend less than you earn. It may sound obvious, but it is surprising how many people fail to follow this principle. To achieve financial freedom, you need to live below your means. That means you should avoid overspending, buying things you don’t need, and living a lifestyle that is beyond your income level. Instead, create a budget and stick to it. Track your expenses, eliminate unnecessary ones, and save as much as you can.

Invest Wisely

Investing your money is one of the best ways to grow your wealth. There are many investment options available, including stocks, bonds, real estate, and mutual funds. The key is to invest wisely and diversify your portfolio. Do not put all your eggs in one basket, but rather spread your investments across different assets. You should also do your research and seek the advice of a financial advisor before investing.

Create Multiple Streams of Income

Having multiple streams of income is essential for building wealth. Relying on a single source of income is risky, especially in today’s uncertain economy. You can create multiple streams of income by starting a side hustle, investing in rental properties, or starting an online business. The key is to find a way to earn more money without sacrificing your primary source of income.

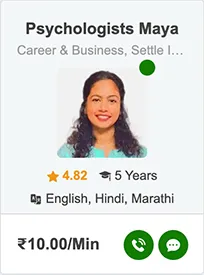

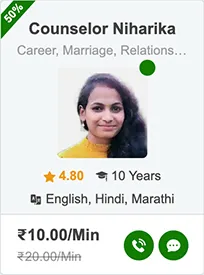

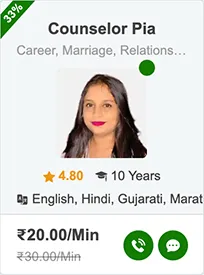

Know, What did our mental wellness expert say about the money and your mood which make your life happy or sad?

Save for Emergencies

Emergencies can happen at any time, and it is essential to have a financial safety net in place. You should aim to have at least three to six months’ worth of living expenses saved in an emergency fund. This can help you avoid going into debt when unexpected expenses arise.

Negotiate Your Salary

If you are working a 9-to-5 job, negotiating your salary can be an effective way to increase your income. Many people are afraid to ask for a raise, but the worst thing that can happen is that your employer says no. You should prepare a list of your accomplishments and be confident in your abilities when negotiating your salary. You can also consider asking for additional benefits such as bonuses or extra vacation days.

Avoid Debt

Debt can be a significant obstacle to building wealth. High-interest debt such as credit card debt can quickly accumulate and make it challenging to get ahead financially. Avoid using credit cards unless you can pay off the balance in full each month. If you have debt, focus on paying it off as quickly as possible. You can consider consolidating your debt or seeking the advice of a financial advisor.

Set Financial Goals

Setting financial goals can help you stay motivated and focused on building wealth. You should create both short-term and long-term goals and be specific about what you want to achieve. For example, you may set a short-term goal of paying off a credit card debt of 50,000 INR in six months or a long-term goal of saving 60 Lakhs for retirement. You should

also track your progress and adjust your goals as necessary.

Automate Your Savings

Saving money can be challenging, especially if you have to remember to transfer funds manually. Automating your savings can make the process easier and less stressful. You can set up automatic transfers from your checking account to a savings account or investment account. This can help you save money.

In conclusion, making more money is a goal that many people strive for, but it can often feel like an elusive target. However, with the right mindset and strategies, it is possible to increase your income and achieve financial stability. Making more money requires a combination of hard work, creativity, and strategy. Whether you decide to start a side hustle, negotiate your salary, or invest in real estate, the key is to take action and remain persistent in your efforts. By implementing these tips, you can increase your income and achieve financial stability.

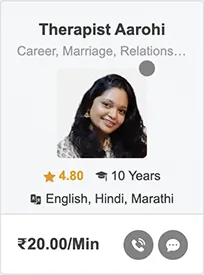

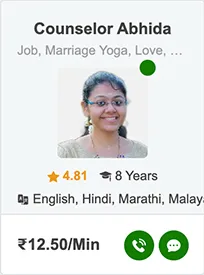

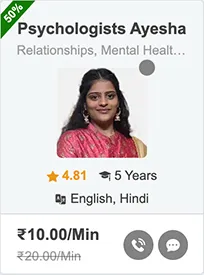

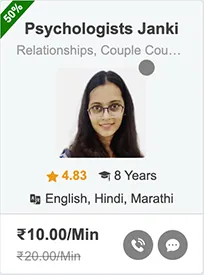

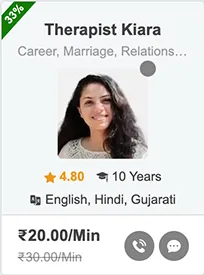

You can also consult an online therapist to know about money-saving tips and its effects on life.